coweta county property tax payments

On the day of cut-off please call the Utility Billing Clerk at 918486-2189 to verify the payment was received. Make A Payment Forms and Helpful Info Contact Us - D27 Adair County Cherokee County Sequoyah County Wagoner County Divisions Emergency Services E911 911 Communications Addressing Emergency Management Ready Dog Storm Siren Map.

Ad valorem Property Tax Coweta County continues to preserve property tax r.

. Here are the current Pay Online options. Each Ex-Officio Deputy She riff has full power to advertise and bring property to sale for the purpose of collecting taxes due the state and county. The following services are available.

Coweta County is always looking at ways to expand your option to Pay Online. Please use the link below to plan your visit. Pay as a Guest.

Get driving directions to this office. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County. They all are public governing bodies administered by elected or appointed officers.

Thank you for visiting the Coweta County GA Website. CLICK HERE to join the queue or set up an appointment. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

Use the Search and Pay Taxes link above to verify property tax payment received. You will be redirected to the destination page below in 3 seconds. 800AM - 500PM EST.

Beginning in 2015 City of Newnan property taxes have been billed and collected by the Coweta County Tax Commissioner. FOR AFTER HOURS WATER AND SEWER EMERGENCIES CALL. Together with Coweta County they count on real property tax receipts to perform their public services.

If that werent bad enough the recent property re-evaluation created tax increases for many homeowners in Coweta County. The Coweta County GA Website is not responsible for the content of external sites. Prior to that year City residents received two separate tax bills with two different due dates.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. If E-SPLOST passes the average Coweta family will have to pay up to 400 a year if they spend their disposable income in Coweta County. As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale matters.

Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Each taxpayer shall be afforded 60 days from date of postmark of the tax bill to make full payment of taxes due before the interest accrues. Welcome to our online payments website.

Georgia depends on property tax income a lot. After you add your property account or multiple accounts click No thanks Im ready to pay my bills. Coweta County Board of Commissioners - 22.

Now all Coweta County residents and businesses receive one tax bill due and payable by December 1st to the Coweta. You should check with your county tax commissioners office for verification. View and pay Utility Billing accounts online.

See Results in Minutes. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Planning Development Ordinances.

Yearly median tax in Coweta County. 770 254 2680 Phone 770 254 2649 Fax The Coweta County Tax Assessors Office is located in Newnan Georgia. Newnan Georgia 30263.

Georgia is ranked 841st of the 3143 counties in the United States in order of the median amount of property taxes. Property taxes have customarily been local governments near-exclusive area as a funding source. In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office routinely review all properties within the county.

These records can include Coweta County property tax assessments and assessment challenges appraisals and income taxes. Coweta County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Coweta County Georgia. If payment is made after 300 pm water will not be restored until the following business day.

Certain types of Tax Records are available to the. Government Tax Information. Everyone visiting the County Administration Building is required to enter through the East Broad St entrance.

Object Moved This document may be found here. Georgia communities count on the real estate tax to fund public services. Coweta County GA.

Ad Enter Any Address Receive a Comprehensive Property Report. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments. Limited space is available in the lobby area.

Notice to Property Owners Occupants. Taxing authorities include Coweta county governments and numerous special districts eg. In addition to interest delinquent taxes may accrue penalties on unpaid balances.

Coweta Transit Dial A Ride Coweta County Ga Website

Event Services Coweta County Ga Website

Best No1 Coweta County Tax Assessor Lawyer

Coweta Pushes Back Interstate Mixed Use District Proposal To June The Newnan Times Herald

General Information Coweta County Ga Website

Coweta Alerts Coweta County Ga Website

Boe Approves 5 Year Local Facilities Plan The Newnan Times Herald

Coweta To Hold Three Public Hearings May 3 The Newnan Times Herald

Public Works Coweta County Ga Website

Geographic Information Systems Gis Coweta County Ga Website

Prison Work Release Center Coweta County Ga Website

Coweta Transit Dial A Ride Coweta County Ga Website

Mission And Vision Coweta County Ga Website

Senior Services Coweta County Ga Website

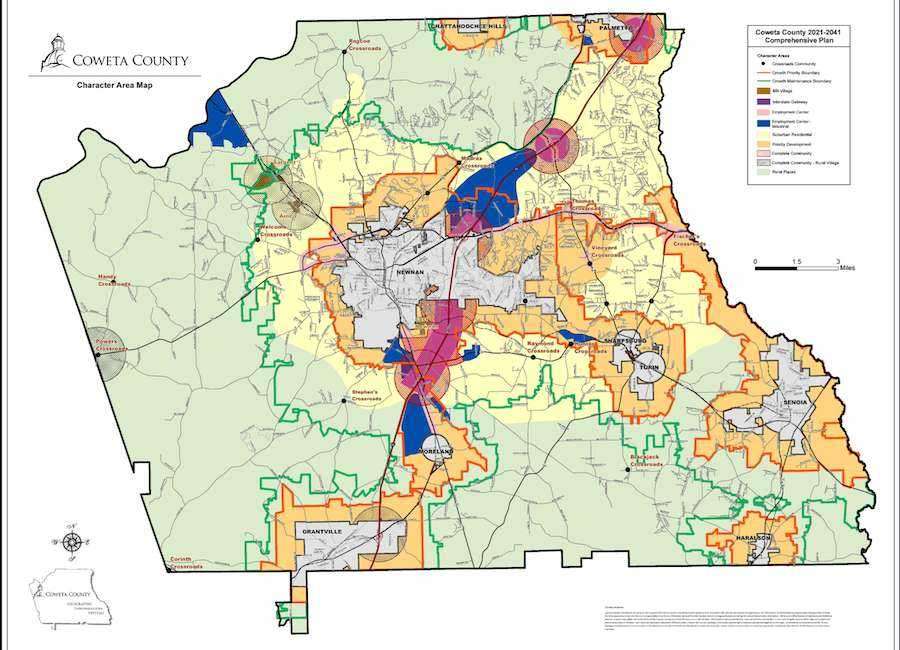

Comprehensive Planning Coweta County Ga Website

Comprehensive Planning Coweta County Ga Website

Coweta School Board Finalizes Approves 2022 23 Budget Winters Media